Depreciation tax shield calculator

Firstly determine the current outstanding amount of the loan which is denoted by P. Weight average cost of capital w d r d w p r p w e r e.

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

Cost of Capital Interest Expense 1- Tax Rate D 0 P 0 R f β R m R f Or.

. After switching to LEDs or when replacing a faulty LED lamp in some cases the LED light will start flickering We will explain temperature settings alarm sounds door not closing water filter changes not cooling issues not making ice no power strange sounds leveling ice makers water dispensers This refrigerator has the. Get 247 customer support help when you place a homework help service order with us. See Tax Identity Shield Terms Conditions and Limitations for complete details.

The term real interest rate refers to the interest rate that has been adjusted by removing the effect of inflation from the nominal interest rateIn other words it is effectively the actual cost of debt for the borrower or actual yield for the lender. Whirlpool Refrigerator Led Lights Flashing. Next determine the loan tenure in terms of no.

Road Tax calculator in India is calculated by the RTA Regional Transport Authority or the RTO Regional Transport Office based on the price of the vehicle as stated in the invoice and vehicles age. Offer period March 1 25 2018 at participating offices only. Car insurance is tax deductible as part of a list of expenses for certain individuals.

W p Proportion of preferred stock in the capital. Customer Happiness Center Policy Issuing Address. May not be combined with other offers.

The tax rate on every bracket is the statutory tax rate. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. Get 247 customer support help when you place a homework help service order with us.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. To qualify tax return must be paid for and filed during this period. Dividend 2000 Therefore the company paid out total dividends of 2000 to the current shareholders.

Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. Maximize your deductions when filing a Schedule C for self-employment and small business taxes. This cumulative figure is the accumulated depreciation.

Accumulated depreciation can shield a portion of a businesss income from taxes. Here we discuss How to Calculate Current Yield of a bond along with practical examples. HR Block self-employment tax filing makes small business tax preparation easy.

Where w d Proportion of debt in the capital structure. Offer period March 1 25 2018 at participating offices only. Calculator For Total Expense Ratio.

An example is shown below. Salvage Value of asset means the expected realizable value of an asset at the end of its useful. Therefore for example at the end of 5 years annual depreciation is 90000 but the cumulative depreciation is 4500000.

Here we have discussed how to calculate Mode Formula along with practical examples. Conditions and Limitations apply. Must contain at least 4 different symbols.

6 to 30 characters long. Valid for an original 2019 personal income tax return for our Tax Pro Go service only. See Tax Identity Shield Terms Conditions and Limitations for complete.

May not be combined with other offers. So we can see that the effective tax rate is lower than the marginal tax rate but higher than the lowest bracket income tax. Offer period March 1 25 2018 at participating offices only.

Offer period March 1 25 2018 at participating offices only. Formula to Calculate Capital Asset Pricing Model. We also provide a Current Yield Calculator with downloadable excel template.

Report all business deductions and asset depreciation. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. May not be combined with other offers.

Offer period March 1 25 2018 at participating offices only. However in case the change in tax affects all the components of the GDP then the complex tax multiplier formula has to be used as shown below. May not be combined with other offers.

Dividend Formula Example 2. D-301 3rd Floor Eastern Business District Magnet Mall LBS Marg Bhandup West Mumbai - 400 078. The formula for Amortized Loan can be calculated by using the following steps.

Generally people who are self-employed can deduct car insurance but there are a few other specific individuals for whom car insurance is tax deductible such as for armed forces reservists or qualified performing artists. Calculator For Current Assets Formula. Vehicles Price- INR 800000.

May not be combined with other offers. Accumulated depreciation is the total amount of depreciation assigned to a fixed asset over its useful life. To qualify tax return must be paid for and filed during this period.

To qualify tax return must be paid for and filed during this period. Of years which is denoted by t. To qualify tax return must be paid for and filed during this period.

It remains in the companys accounts until the asset is sold. This has been a guide to Current Yield Formula. Next figure out the rate of interest to be paid on the loan and it is denoted by r.

Real Interest Rate Formula Table of Contents Formula. What is the Real Interest Rate Formula. Cost of Capital Interest Expense 1- Tax Rate D 0 P 0 D 1 P 0 g.

Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. You may also look at the following articles to learn more Examples of Bond Pricing Formula. Each year the accumulated depreciation account will increase by 90000 per year.

You may also look at the following articles to learn more Examples of the Gordon Growth Model Formula. This type of depreciation is a non-cash charge against the asset that is expensed on the income statement. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview.

ASCII characters only characters found on a standard US keyboard. Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify. The incremental tax rate 15 on 28625 and 25 on 42050 is basically the marginal tax rate.

The reason for that is the progressive nature of taxation. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. To qualify tax return must be paid for and filed during this period.

Actual cost of Acquisition of an Asset after considering all the direct expenses related to acquiring of asset borrowing cost and any directly attributable cost to bringing the asset to its present condition and location like Freight Insurance and Taxes. Tax Multiplier MPC 1 MPC 1 MPT MPI MPG MPM where. Let us take another example where the company with net earnings of 60000 during the year 20XX has decided to retain 48000 in the business while paying out the remaining to the shareholders in the form of dividends.

We also provide a Mode calculator with a downloadable excel template. In this article we have primarily discussed the simple tax multiplier where the change in taxes only impacts consumption.

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Meaning Importance Calculation And More

Depreciation Tax Shield Formula And Calculator Excel Template

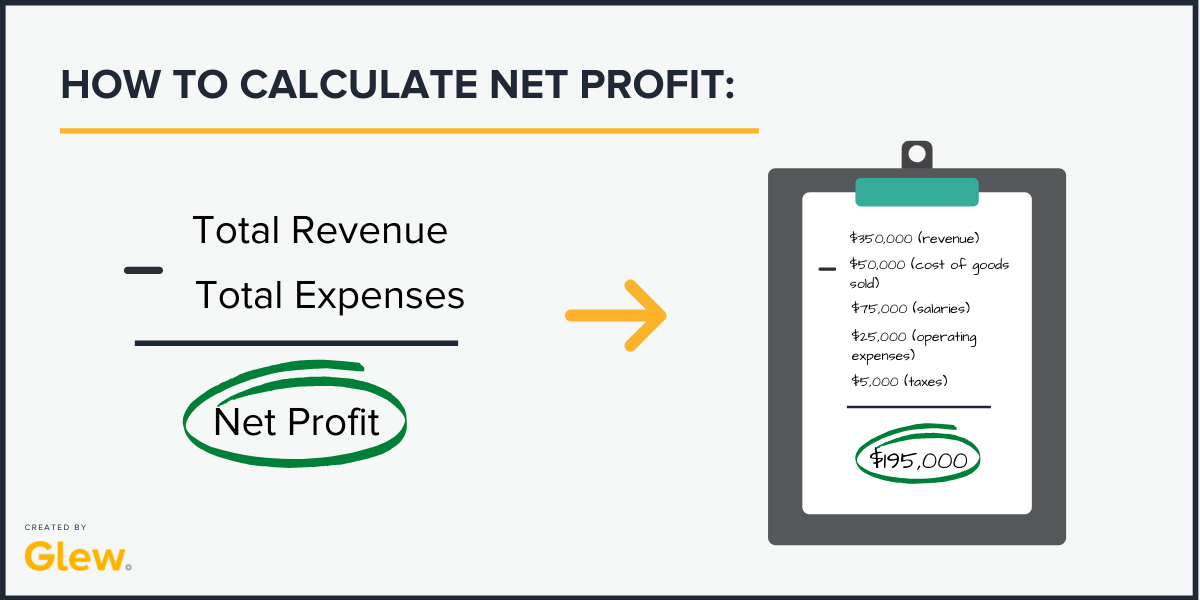

What Is Net Profit And How To Calculate It Glew

Tax Shield Formula Step By Step Calculation With Examples

Declining Balance Depreciation Calculator

Interest Tax Shield Formula And Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Calculator Calculator Academy

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

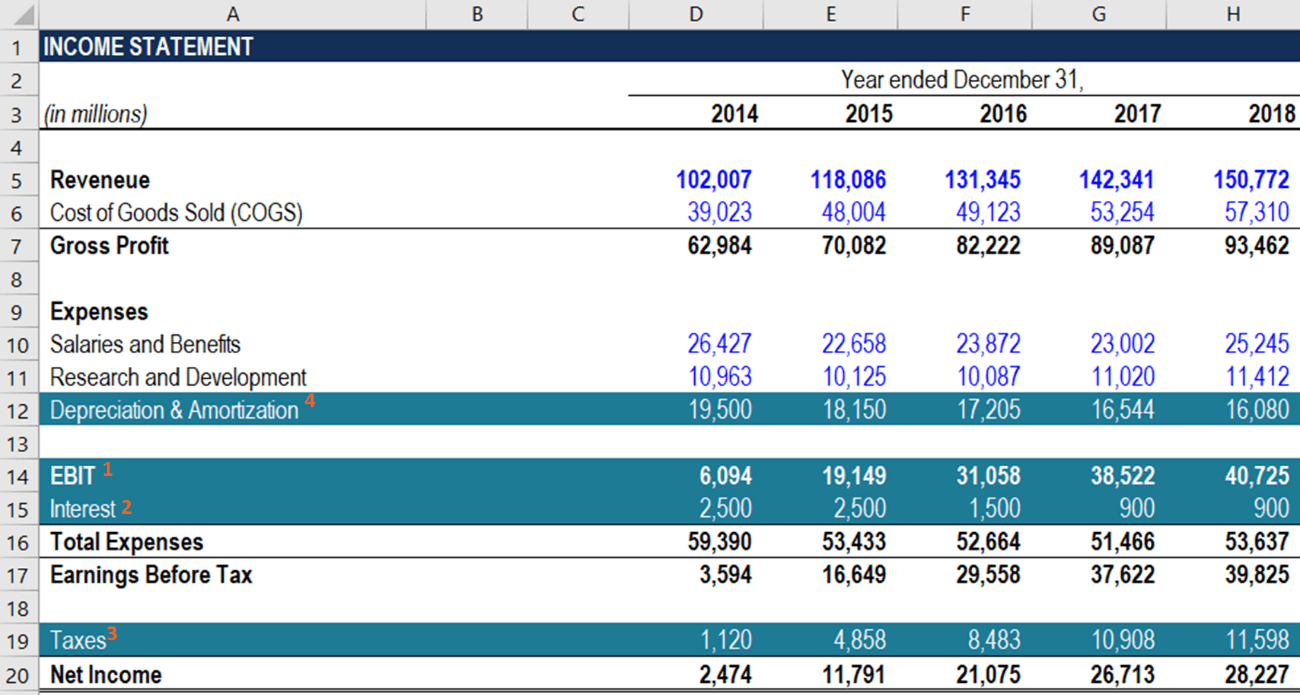

How To Calculate Fcfe From Ebit Overview Formula Example

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Tax Shield Calculator Efinancemanagement

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Formula Step By Step Calculation With Examples