Usda home loan how much can i borrow

Finally dont buy a bigger house than you can afford. Using your existing equity.

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

The loan is secured on the borrowers property through a process.

. It can play a big role in the interest rate that you get since the appraisal helps determine your LTV loan-to-value ratio. 31000 23000 subsidized 7000 unsubsidized Independent. Find a Home in a USDA-Eligible Area.

Since 2010 20-year and 15-year. FHA loans are generally intended for home buyers with lower credit starting at 580. There are two main ways to finance a second home or vacation property.

Your current equity is 300000 220000 or 80000. Youve been preapproved for a USDA home loan. Fairway - Online.

How much can I borrow. Effective September 1 2022 the current interest rate for Single Family Housing Direct home loans is 350 for low-income and very low-income borrowers. Total subsidized and unsubsidized loan limits over the course of your entire education include.

The usual rule of thumb is that you can afford a mortgage two to 25 times your income. Effective September 1 2022 the current interest rate for Single Family Housing Direct home loans is 350 for low-income and very low-income borrowers. USDA home loans are zero down payment mortgages for eligible rural development zones backed by the US.

A USDA construction loan is a mortgage that is guaranteed by the US. The maximum loan amount an applicant qualifies for. So theyre likely not best for.

American Family News formerly One News Now offers news on current events from an evangelical Christian perspective. Like a traditional USDA loan home buyers borrow from a traditional lender and the USDA backs the loanThe difference between the two is that while a typical USDA loan allows a. Most mortgages have a loan term of 30 years.

At 60000 thats a 120000 to 150000 mortgage. Interest rate when modified by payment assistance can be as low as 1. 1 Find a Lender and Prequalify For a USDA Loan.

Check your USDA eligibility USDA loans are the best-kept secret in. And the property must pass a USDA appraisal before final loan approval can be issued. Your home appraisal can also affect your home loan during a refinance.

The United States Department of Agriculture will guarantee your home loan but the entire process is handled through a local bank or lender. Our experienced journalists want to glorify God in what we do. How can funds be used.

Of course youll still need cash for reserves and to cover the loans closing costs. If you owe 150000 and your home is valued at 250000 your new loans LTV would be 60 If the lender allows you to borrow up to 80 LTV 200000 you should have plenty of room to roll in. The first step to getting a USDA loan is finding a USDA-approved lender.

Add your 20000 down payment to this and you can purchase a home of 224913. Your preapproval letter shows sellers and agents youre a lender-verified USDA buyer who can close. Heres what you need to know.

Now its time to find a home in a USDA-eligible area and make an offer. Fixed interest rate based on current market rates at loan approval or loan closing whichever is lower. Working with a lender that specializes in this rural home program can make a big difference for homebuyers.

You could cover all or part of the purchase using the. Interest rate when modified by payment assistance can be as low as 1. You can usually cash out up to 80 of your equity through a home equity loan as lenders usually want a cushion against unforeseen expenses or sudden decreases in the homes selling price.

The USDA home loan process isnt much different than a traditional mortgage program. Two ways to finance a vacation home. Generally if you can afford to make a 20 down payment on top of your mortgage you wont qualify for a USDA loan.

Using a USDA loan buyers can finance 100 of a home purchase price while getting access to better-than-average mortgage rates. Even though USDA Direct Loans are underwritten by the USDA home buyers can still expect a 30-60 day timeline for loan approval. How Much Mortgage Can I Afford if My Income Is 60000.

The amount you can borrow is limited by your income and your. Loan funds can be used to help low-income people or households buy homes in rural areas. Alterra - Fully online application mobile loan tracking borrow with nontraditional credit.

Sometimes known as loan term the length of the loan is the number of years until your home loan is paid in full. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Certain loan programs also offer reduced or zero down payment options such as VA loans for veterans or USDA loans for rural properties.

1400 per month qualifies to borrow a loan amount of 204913. What if I can pay 20 down. For example suppose your home can sell for 300000 and you owe 220000 on your mortgage.

That means you can qualify for a USDA loan with an annual income of 89930 or less. The program is designed to make housing accessible and affordable in rural areas. Fixed interest rate based on current market rates at loan approval or loan closing whichever is lower.

And mortgage insurance is cheaper for a USDA loan than an FHA loan. For example if the LTV ratio is 75 or lower you could get a lower rate because the loan is seen as less risky to the lender. Effective September 1 2022 the current interest rate for Single Family Housing Direct home loans is 350 for low-income and very low-income borrowers.

USDA loans limit how much homebuyers can borrow in addition to setting income limits. USDA limits are often confused with maximum loan limits applying to FHA or other home loans regardless of the buyer repayment ability. Fixed interest rate based on current market rates at loan approval or loan closing whichever is lower.

Interest rate when modified by payment assistance can be as low as 1. Hundreds of lenders make USDA loans but some might only make a few of them every year. Maximum loan limits do not apply to USDA home loans.

15 of 78200 is equivalent to 11730 which we added to 78200 to obtain the 89930 income limit. Department of Agriculture USDA. Funds can be used to build repair renovate or relocate a home or to purchase and prepare sites including providing water and waste treatment equipment.

In reality there is no such rule for USDA home loans.

100 Financing Rural Development Loan Development Rural Next At Home

How To Finance Building Your Homestead Homestead Hustle How To Buy Land Construction Loans Homesteading

How Much A 350 000 Mortgage Will Cost You Credible

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Pin By Anseth Richards On Farm Loans Farm Loan The Borrowers Borrow Money

Usda Rural Home Loans Explained Nextadvisor With Time

Decoding The Factors That Determine Your Credit Score Infographic Daily Infographic Credit Score Infographic Credit Repair Credit Card Infographic

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

How Much Do You Need For A Down Payment On A House Business Insider Down Payment Usda Loan Do You Need

What Is A Usda Loan Am I Eligible For One Nerdwallet

Investing Calculator Borrow Money

Bp Federal Credit Union Mortgage Rates Review Good Financial Cents Mortgage Rates Fha Loans Mortgage

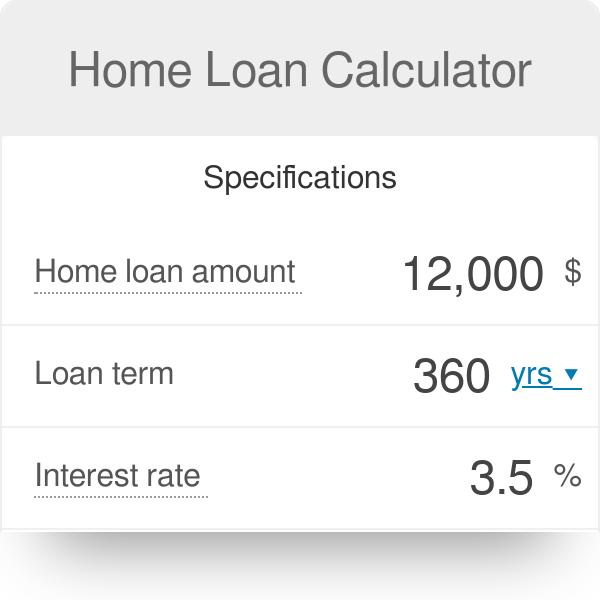

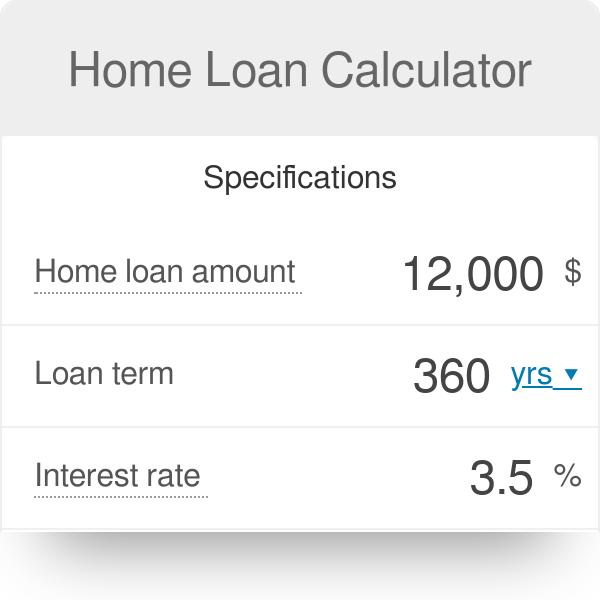

Home Loan Calculator House Loan Calculator

Usda Guaranteed Loan In 2022 Guaranteed Loan Usda Loan Money Management

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Pin On Quick Saves

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator